H.R. 1319 creates a Homeowner Assistance Fund (HAF) where "homeowner’s association, condominium association fees, or common charges” qualify as expenses that may be paid from the fund. This marks the

first time the federal government has elevated payment of community association assessment delinquencies to the same level as mortgage delinquencies in emergency housing legislation.

Governors must notify the federal government their state will participate in the Homeowner Assistance Fund. Only those states electing to participate in the Homeowner Assistance Fund during the 45-day signup period will receive an allocation to create state Homeowner Assistance Fund programs.

Please note that the deadline for states to either submit HAF Plans or notify Treasury of the date by which their HAF plan was extended to July 31, 2021.

Click here to learn more.

-- Back to Summary--

*** Click here to read

CAI's Guide to Small Business Administration (SBA) EIDL ***

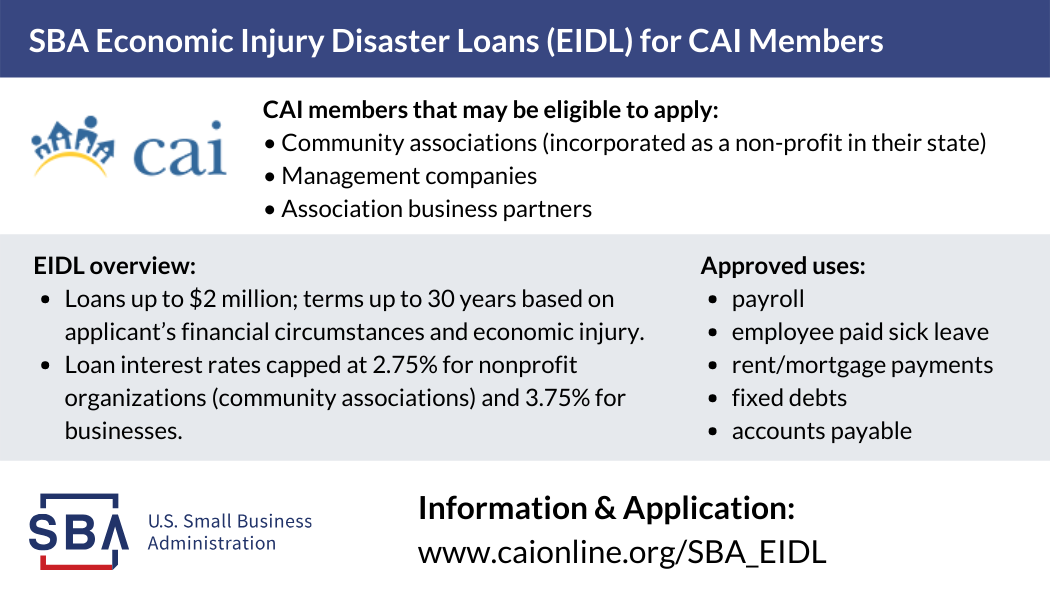

The Federal government’s SBA Economic Injury Disaster Loan (EIDL) provides long-term, low-interest loans to stabilize nonprofit organizations (community associations) and small businesses experiencing a substantial economic injury as a result of the COVID-19 national emergency. The EIDL is used for working capital necessary until normal operations are resumed.

EIDLs may not fund expenses like payment of dividends and bonuses, expansions of facilities, retiring federal debt (except IRS obligations), or relocation expenses.

-- Back to Summary--

Credit Reporting

Community associations reporting payment information to credit bureaus (Experian, TransUnion, Equifax) are required to report accounts as current if the association offers an owner a flexible assessment payment plan (an accommodation) during the COVID-19 national emergency.

The CARES Act defines an “accommodation" as a payment deferral, allowing partial payments, delinquency forgiveness, or other delinquency workout. If an association offers an assessment accommodation for homeowners, the association must report homeowner accounts as current.

If a homeowner had a delinquency prior to January 1, 2020, that portion of the owner's assessment obligation may continue to be reported as delinquent. If the owner brings a pre-January 1, 2020, delinquent account current and receives an assessment accommodation from the association, the association must report the account as current.

National Mortgage Forbearance

The CARES Act allows any homeowner experiencing a financial hardship due to the COVID-19 national emergency to request up to 60 days mortgage loan forbearance. A homeowner may request mortgage forbearance even if the mortgage is current—there is no requirement a borrower miss mortgage payments to qualify for mortgage forbearance.

Borrowers may request up to 4 additional 30-day extensions of mortgage forbearance, but the requests must be made prior to December 31, 2020, or the termination of President Trump's national emergency declaration, whichever occurs sooner.

During a forbearance period, lenders may not report negative credit information to credit bureaus and only fees and interest that would have come due if the account were current are permitted to accrue to the borrower's account.

The national mortgage forbearance applies to federally backed mortgages, which include mortgages—

- insured by the Federal Housing Administration

- guaranteed or insured by the Veterans Benefits Administration

- guaranteed or originated by the U.S. Department of Agriculture

- backed by Fannie Mae or Freddie Mac.

National Mortgage Foreclosure Moratorium

The CARES Act imposes a nationwide foreclosure moratorium for federally backed mortgages. Approximately 65% of mortgages nationwide are considered federally backed mortgages.

The foreclosure moratorium expires March 31, 2021, or when the COVID-19 national emergency declaration, whichever occurs sooner.

The CARES Act does not impose a moratorium on community association foreclosures. Please refer to CAI's statement on community association foreclosures during the COVID-19 national emergency.

State and local government are imposing foreclosure moratoria. For more information on state government emergency declarations and mortgage foreclosure moratoria, visit CAI's State Government COVID-19 emergency action information clearinghouse.

National Moratorium on Evictions

The national government response to the COVID-19 pandemic relies on individuals and households sheltering in place and practicing social distancing. The CARES Act national eviction moratorium supports this policy.

The CARES Act national eviction moratorium is intentionally broad and applies to—

- housing occupied with or without a residential lease or with a lease that is terminable under state law

- to any property with a federally backed mortgage

- all housing units subject to the Federal Fair Housing Act, expanded to include properties subject to the small landlord exemption

For the 120-day period following enactment of the CARES Act, no lessor may petition a court to recover possession of a dwelling due to nonpayment of rent, fees, or other charges. Lessors may not assess monetary penalties for nonpayment of rent during the eviction moratorium.

Following expiration of the 120-day moratorium, lessors may petition to recover possession of a dwelling. Lessors may not deliver a notice to vacate to tenants during the 120-day moratorium and are required to give tenants no less than 30 days to vacate the dwelling.

-- Back to Summary--

*** Click here to read

CAI's Paycheck Protection Program (PPP) Guide (As of December 22, 2020) ***

Read our blog, "Breaking Down New PPP Regulations and Second Draw Information"

Program Purpose

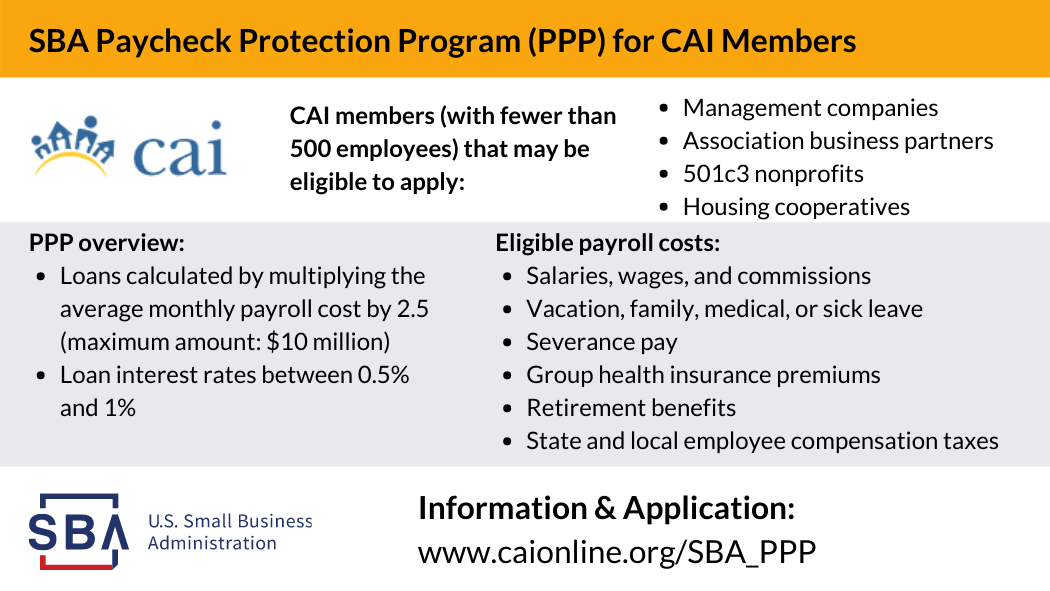

The Small Business Administration 7(a) load and grant program — Paycheck Protection Program (PPP) — helps small businesses and nonprofit organizations remain solvent and retain employees during the COVID-19 pandemic.

Program Eligibility

Businesses that have fewer than 500 employees and most nonprofit organizations are eligible to apply for PPP loans. Sole proprietors, independent contractors, and self-employed individuals are eligible to apply for PPP loans.

Eligibility is limited to businesses, nonprofit organizations, sole proprietors, independent contractors, and self-employed individuals in operation prior to February 15, 2020. Please check with your bank and other professionals for information regarding eligibility.

Automatic Payment Deferral

Borrowers qualify for an automatic 6-month complete payment deferral that includes principal, interest, and fees that may be extended up to 1 year.

Maximum Loan Amount

The maximum loan amount per borrower is the lesser of a formula-based calculation based on payroll obligations or $10 million.

Maximum loan amounts are the product of multiplying the average monthly payroll costs of the one-year period before loan application by 2.5. (i.e., ($25,000 average monthly payroll costs April 1, 2019, to June 30, 2020) X (2.5) = $62,500 maximum loan amount).

Applicants operational prior to February 15, 2020, but not operational for a year will use average payroll costs for January 2020 and February 2020 as the payroll variable in the maximum loan amount formula.

Loan Uses

Borrowers may use loan proceeds to meet eligible payroll costs (see restrictions below); mortgage interest payments; rent; utilities; and interest on other debt incurred before February 15, 2020.

Eligible Payroll Costs | Ineligible Payroll Costs |

salaries, wages, and commissions vacation, family, medical, or sick leave severance pay group health insurance premiums retirement benefits state and local employee compensation taxes | Individual employee compensation that exceeds $100,000 as prorated by program rules Compensation for employees whose principal place of residence is outside of the United States Qualified sick leave wages covered by the Families First Coronavirus Response Act Qualified family leave wages covered by the Families First Coronavirus Response Act |

Loan Forgiveness

Loan disbursements used during the 8 weeks immediately following loan origination to fulfill payroll, rent, utilities, and mortgage interest obligations are eligible to be forgiven.

Loan Terms for Non-Forgivable Balance

Non-forgivable loan balances are payable over a 10-year term with an interest rate of no more than 4 percent.

How to Apply

SBA authorized lenders will manage loan application, disbursement, and payments. This program is currently unavailable pending new legislation.

-- Back to Summary--

- Companies with fewer than 500 workers are required to provide

12 weeks of partially paid Public Health Emergency Leave to employees that have been employed at least 30 calendar days, and who are unable to work (or telework) due to:

- a need to care for a child under age 18 whose school or day care has been closed or

- the unavailability of a childcare provider due to a public health emergency (declared by a Federal, State, or local authority)

- Full-time and part-time workers must be provided

two weeks paid leave if under a quarantine order or if caring for quarantined or ill member of the household.

- An employee may elect to use other paid leave (vacation, sick leave, personal leave) during the unpaid leave period.

- The U.S. Department of Labor may exempt businesses with fewer than 50 employees from paid leave requirements and public health emergency leave mandates if compliance will jeopardize the viability of the business.

- Program funded through refundable tax credits.

Family Leave Program Detail-

Length: up to 12 weeks (offset by prior use of Family and Medical Leave Act annual allotment).

-

Leave structure: unpaid for first 10 days, then at least 2/3 of normal pay, capped at $200 per day and not to exceed $10,000 in total benefits.

-

Employer Tax Credit: up to $200 per day of wages advanced, capped at $10,000 total.

- Self-employed Tax Credit: the lesser of $200 per day or 67% of average daily self-employed income.

|

Emergency Paid Sick Leave Act

- Employers are required to provide paid sick leave during the COVID-19 public health emergency to employees due to:

- a Federal, State, or local quarantine order.

- a recommendation from a healthcare provider to self-quarantine.

- the employee experiencing known COVID-19 symptoms and is seeking a medical diagnosis.

- the employee is caring for an individual subject to a quarantine order or who has been advised by a healthcare provider to self-quarantine.

- the employee is caring for a “son or daughter" if the school or childcare center or childcare provider is closed or unavailable due to the COVID-19 public health emergency.

Sick Leave Program Detail- Amount of Sick Leave—

- 80 hours of sick leave for full-time employees

- Number of hours a part-time employee works, on average, over a two-week period

- Sick leave authorized under the Act is to be available immediately with no accrual period.

- Employers must post information on emergency paid sick leave in conspicuous locations.

- Benefit Amount:

-

For a worker with a positive COVID-19 diagnosis or under quarantine order - normal wage or applicable minimum wage, whichever is greater, capped at $5,110

-

For a caregiver - 2/3 of normal or applicable minimum wage, capped at $2,200

- Employer Tax Credit: 100 percent of eligible paid sick leave advances

- Self-employed Tax Credit:

-

For self-employed individuals subject to a quarantine order, physician self-quarantine request, or are seeking a COVID-19 diagnosis - a self-employment tax credit equal to eligible lost wage amounts ($511 per day limit)

-

For self-employed individual acting as a caregiver - the lesser of $200 or 67% of average daily self-employed income

|

-- Back to Summary--